As an Employer, your support and contributions towards your Employees' welfare and social security go a long way. It is important to know and understand Employers' responsibilities so that we can realize this. Together, we join hands to make an impact towards better and sustainable social security, in line with achieving Brunei's Vision 2035 for a high standard of living.

Employers' Responsibilities

Ensure registration as an Employer

Upon registration of company under Registry of Companies and Business Names (ROCBN), your company will be automatically registered to TAP.

A company registered before 2009 will be required to apply via TAP’s online service portal, e-Amanah.

Ensure Employees are registered

For existing Employee registration (Employees already registered with TAP): Please log in to e-Amanah to update the Employee’s details.

For new member registration (Employees who have never been registered with TAP): Please log in to e-Amanah to register and ensure to upload a copy of the Employee’s identity card.

Submission of Contributions for Employers and Employees

Note:

All Employee matters such as registration and contribution payments can be completed via TAP’s online service portal, e-Amanah.

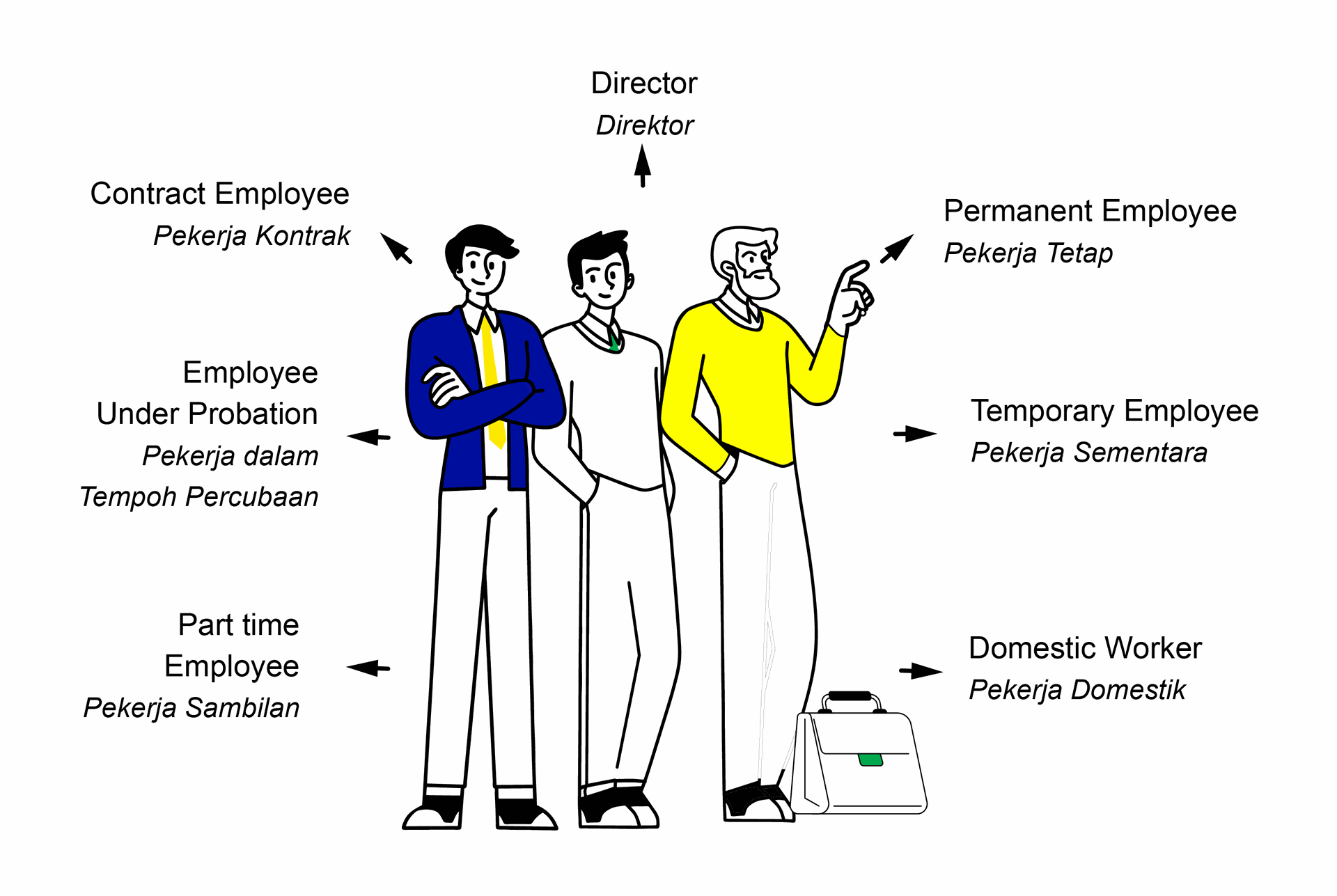

Eligibility of Employee for Registration

Citizenship

Citizen and Permanent Residents of Brunei Darussalam

Age

Below 60 years old

Employers' Contribution

Forms

Employer Registration & Amendment Form (TAP/SCP)

Request for TAP Bank Account Number

Refund of Contribution