Who has the option to make a top-up payment in Gold Generation?

Members who are 60 years old and above before the effective date of SPK:

Members who are Citizens or Permanent Residents (no foreign nationality) of Brunei Darussalam above 60 years old.

Members who have previously withdrawn SCP balance in a lump sum.

Members with an SCP balance of below $12,000.00 who have not made a withdrawal yet.

Why does a Gold Generation Member have the option to make a top-up payment?

SCP Balance is less than $12,000.00

Prior to the effective date of SPK on the 15th of July 2023, if a Gold Generation Member had withdrawn the SCP balance in a lump sum due to the amount being less than $12,000.00, the Member has the option to make a top-up payment.

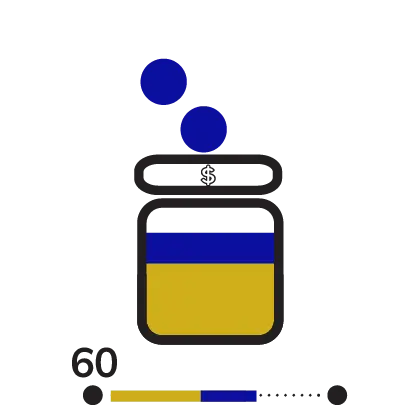

Top-up to receive up to a lifetime SPK Annuity

The top-up payment is an option to allow the Gold Generation Member to cover part of the minimum requirement to receive a minimum annuity of $250 per month, paid for a lifetime.

Type of Top-Up Payment

Full Top-up Payment

Member can make a full top-up payment to receive SPK Gold Annuity payout for a lifetime.

Partial Top-up Payment

Member can make a partial top-up payment of any amount to increase the payout period of SPK Gold Annuity (payout period will be extended).

No Top-up Payment

Member can opt not to make a top-up payment. There will be no change to the SPK Gold Annuity period.

Things a Gold Generation Member should know about Top-Up Payment

Top-Up payment must be made within 1 year from SPK implementation date.

Top-Up payment can only be made ONCE into the Retirement Account.

Member can make a Top-Up payment with the following steps:

Cash or Cheque

Member can make a Top-Up payment at the TAP counter.

Bill payment via mobile or internet banking

Member needs to obtain their SPK Account Number.

Login to your bank’s Internet Banking.

Select Bill Payment services and choose Tabung Amanah Pekerja from the institution options.

Ensure to fill in the correct payment details:

SPK Account number

Identity Card number

Payment amount

FAQ

Frequently Asked Questions

For Members who are currently receiving SCP60 on a monthly basis (annuity), is there a

change in the monthly payment?

SCP Members who are currently receiving SCP60 annuity payments on a monthly basis will be converted to the SPK Gold scheme and will receive SPK annuity. Under the new SPK Gold scheme, the Government will make contributions to ensure that Members receive a lifetime annuity payment of at least $250.00.

I was in SCP scheme previously and made lump sum withdrawal. Can I join SPK?

Yes, you can join SPK even if you had previously made a lump sum withdrawal from the SCP scheme. As an SCP Member, you will be eligible to join SPK Gold and receive SPK annuity payments of not less than $250 per month. To proceed with receiving SPK Gold, please visit any TAP branch and complete the required form. Ensure to bring your original Identity Card (IC) and relevant bank account details such as a bank card, bank statement, or bank book, as your SPK annuity payments will be transferred directly to your bank account every month. Please note that this provision is applicable only to Yellow IC holders and Purple IC holders without foreign citizenship.

Do I need to top up to SPK once it is launched to receive $250 annuity amount?

No, top-up to SPK is not necessary in order to receive the updated annuity amount of not less than $250 per month.

However, for Members with SCP balance less than $12,000 at the age of 60 years old, they have the option to top-up any amount to SPK and will benefit from monthly annuity payments up to lifetime. To receive a lifetime annuity payment, Member will only require to top up to reach $12,000 based on their SCP savings at the age of 60 years old.

For example, at age 60 years old, SCP balance = $10,000.

To receive annuity monthly payment for lifetime, Member can top-up $2,000 in order to accommodate the shortage.

At the same time, Member can top-up any amount they wish to but not more than the amount required to reach $12,000. However, Member will receive $250 annuity and benefit from a longer period of annuity monthly payment.

I am currently 60 years old and receiving pension. Will I receive the annuity payment under

SPK also?

No, those who are currently receiving pension are excluded to receive the benefit annuity payment under SPK.