Benefits of Nominating an Administrator

Administrator nomination is applicable for SPK Members to ensure that there is an Administrator to distribute the Member's account balance in the event of the Member's death.

SPK Members can nominate the Administrator(s) whom they trust to distribute their account balance to the beneficiaries accordingly.

The account balance withdrawal process is shortened and simplified as the nominated Administrator is able to make application for the Next-of-Kin Withdrawal.

The withdrawal payment will be made directly to the appointed Administrator for distribution to the beneficiaries accordingly.

Things Member Need to Know About Withdrawal Payment to Administrator Nomination

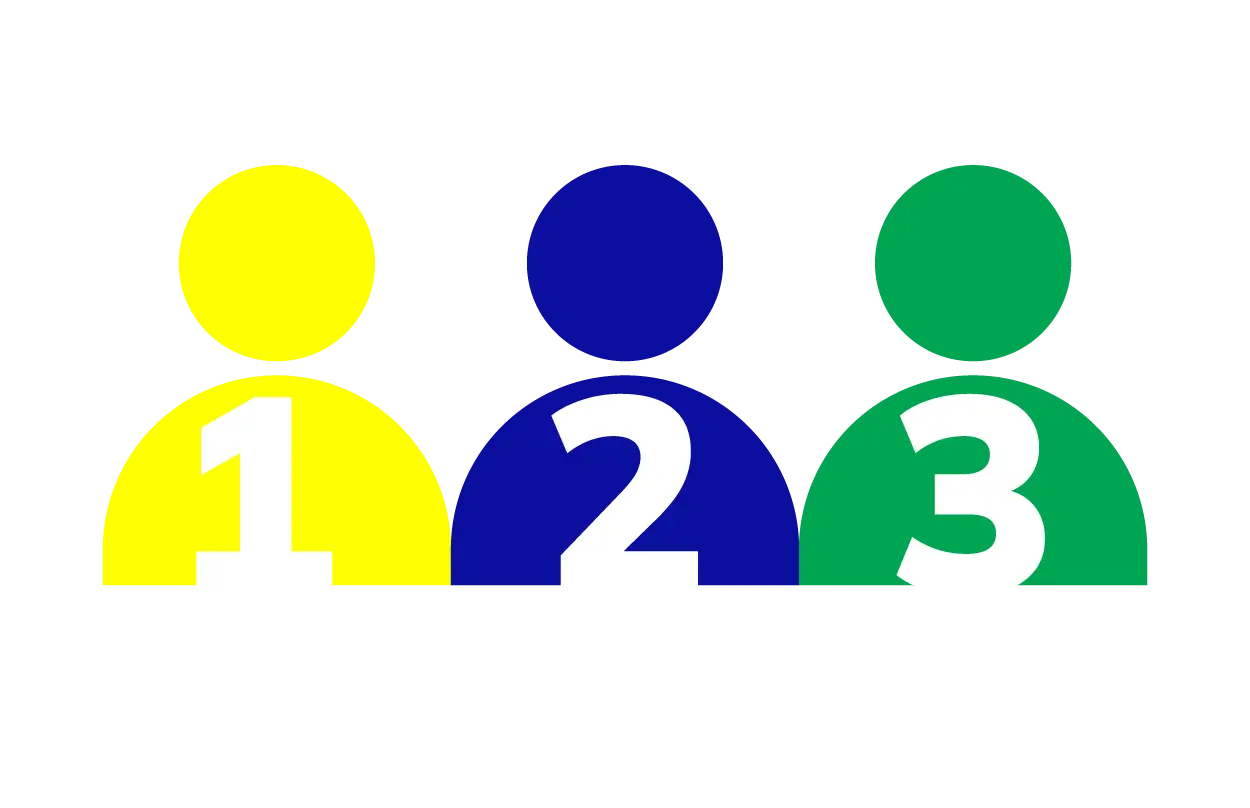

Administrator Priority:

Members can decide on the priority of the Administrator from first to third Administrator.

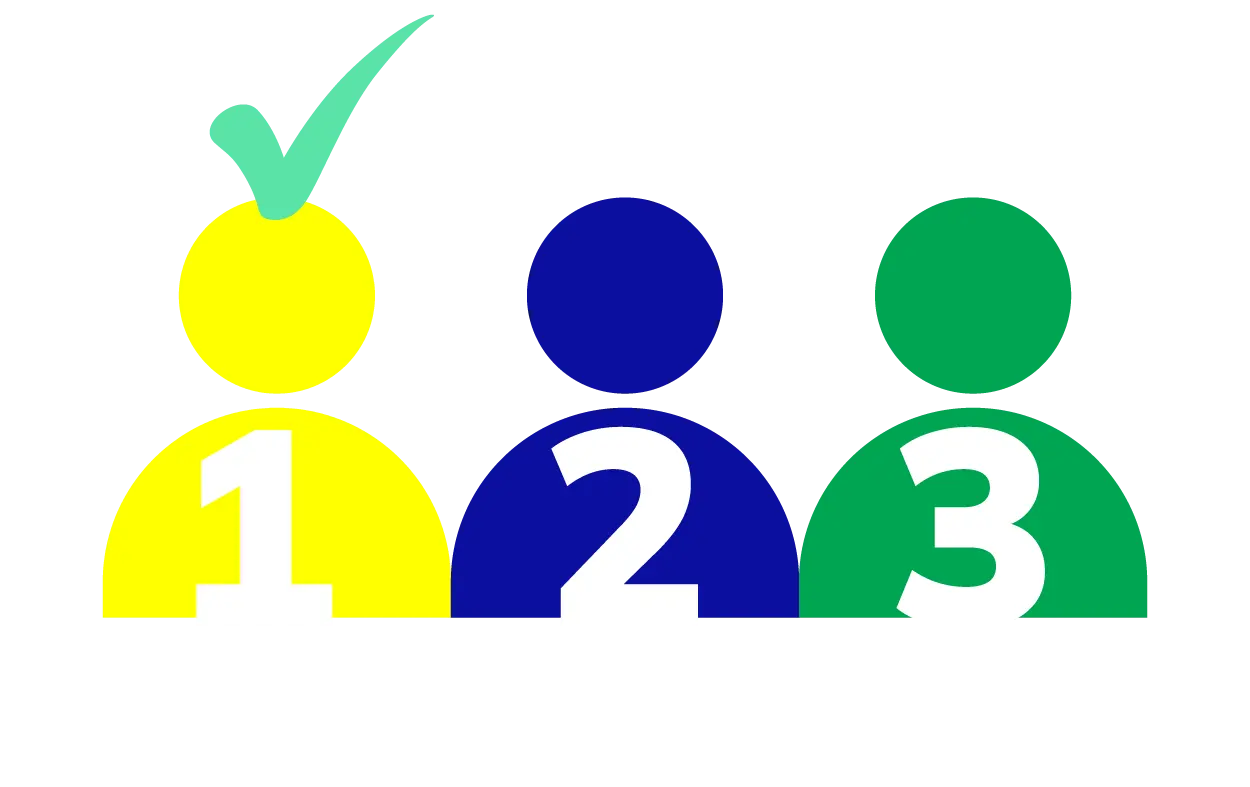

Payment to First Administrator:

In the event of death, the Member’s savings or Derivative Benefit balance will be paid to the first Administrator Nominee who is responsible for distributing the amount to the respective beneficiaries.

Substitute Administrator:

If the first Administrator Nominee is unable to carry out the duties as Administrator due to death, unsound mind, or physical/mobility impairment, the following Administrator Nominee (if any) will receive the Member’s savings or Derivative Benefit balance.

If no Administrator is nominated or unable to carry out the duties,

Beneficiaries are required to obtain an Administration Appointment Letter from the Probate Office or a Faraid Certificate from Syariah Court.

Payment will be made to the appointed Administrator by the Probate Office or beneficiaries stated in the Faraid Certificate from Syariah Court.

For non-Muslims, the payment is made in accordance with the will, or if there is no will, in accordance with the law relating to intestate succession.