Housing Fund Scheme Contribution

The amount of monthly contribution depends on the participants' financial capability.

No contribution from the Employer is required.

General Contribution Guidelines:

Contributions are voluntary and not compulsory; you may choose to contribute as per your financial situation.

There is no minimum or maximum amount for contributions.

Every contribution made will receive a dividend return.

Contributions and dividends can be withdrawn once in a lump sum; the account will be closed after withdrawal.

Financial Assistance of $25,000:

For eligible Members aiming for the Financial Assistance of $25,000, there is a minimum contribution requirement.

To qualify for this assistance, eligible Members must contribute consistently every month without missing any payments.

Steps to Contribute into Housing Fund Scheme Online

Step 1

Log In to Mobile Banking

Check with your bank if it has Tabung Amanah Pekerja as option for payment. If there is, log in to your mobile banking.

Step 2

Go to Bill Payment via Mobile Banking

Navigate to the 'Bill Payment' option and select Tabung Amanah Pekerja as the recipient of the payment / payee.

Step 3

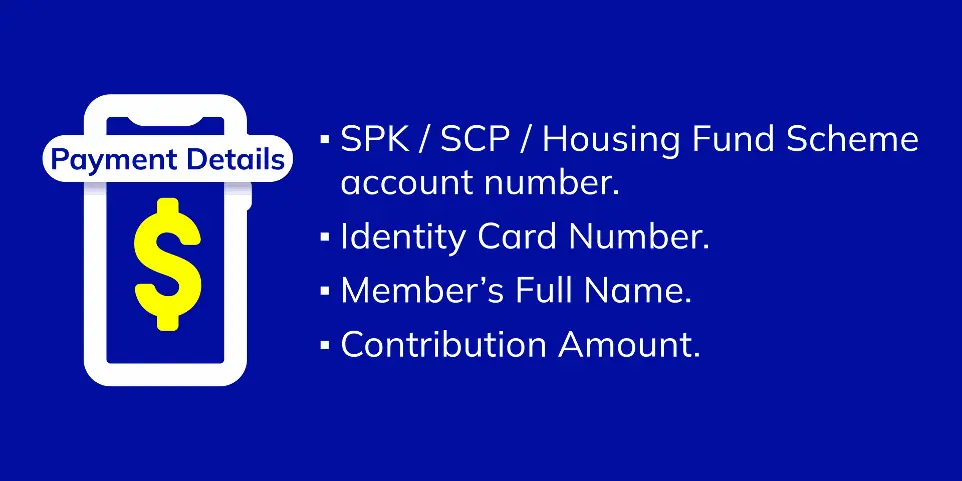

Key-in Payment details

Enter your Housing Fund Scheme Account number (8XXXXXXXX) and the amount to be paid as your voluntary contribution.