What is Member Account of SPK?

A Member Account is an account where all contributions made by the Member, as well as voluntary contributions from the Member and Employer, are credited.

Contribution Rate

8.5% of basic salary every month.

What is the definition of wages that is deductible for SPK?

Wages refer to the remuneration in money due to an Employee for work done. This includes, among other things, basic salary. For Employees who do not have a basic salary, it includes any remuneration received based on work done, such as allowances, apprentice allowances, commissions, or directors' fees.

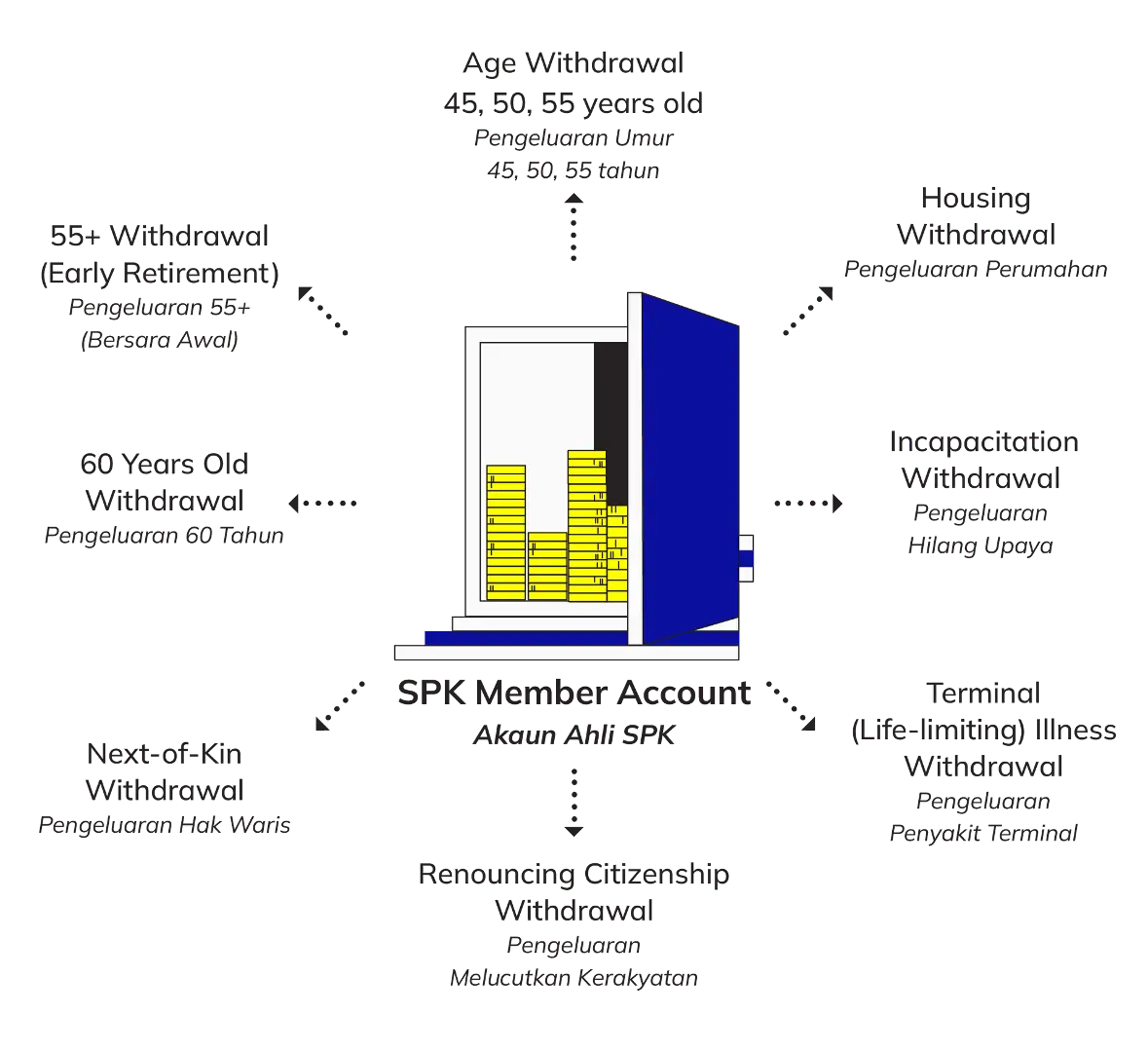

What can you do with your SPK Member Account?

Based on withdrawal eligibility, members can make the following withdrawal schemes for pre-retirement purposes.