Contribution by Unverified SPK Self-Employed Members

Any contributions made, regardless of the amount, will be treated as voluntary contributions to the SPK Member Account.

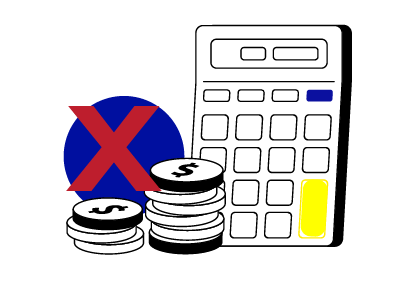

- The Member will not be eligible for the Government Match-Up contribution.

- However, they will still be able to enjoy benefits from the SPK Member Account, including withdrawals for pre-retirement purposes, subject to eligibility.

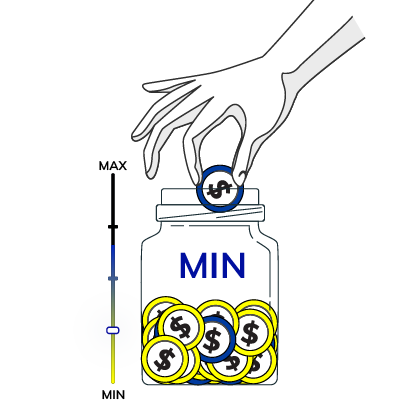

Minimum Contribution

There is no minimum contribution required for voluntary contributions to the SPK Member Account.